#Boost

Intimate learning sessions led by scale leaders and experts

Europe is firmly positioned as a global tech player in 2021, with a record $100b of capital invested, 98 new unicorns, and the strongest ever startup pipeline, putting the continent on par with the US.

European tech is now creating value at its fastest pace, adding $1t in just eight months. While geographical differences in maturity level remain, talent mobility and distributed success is significantly contributing to multiple powerful new hubs.

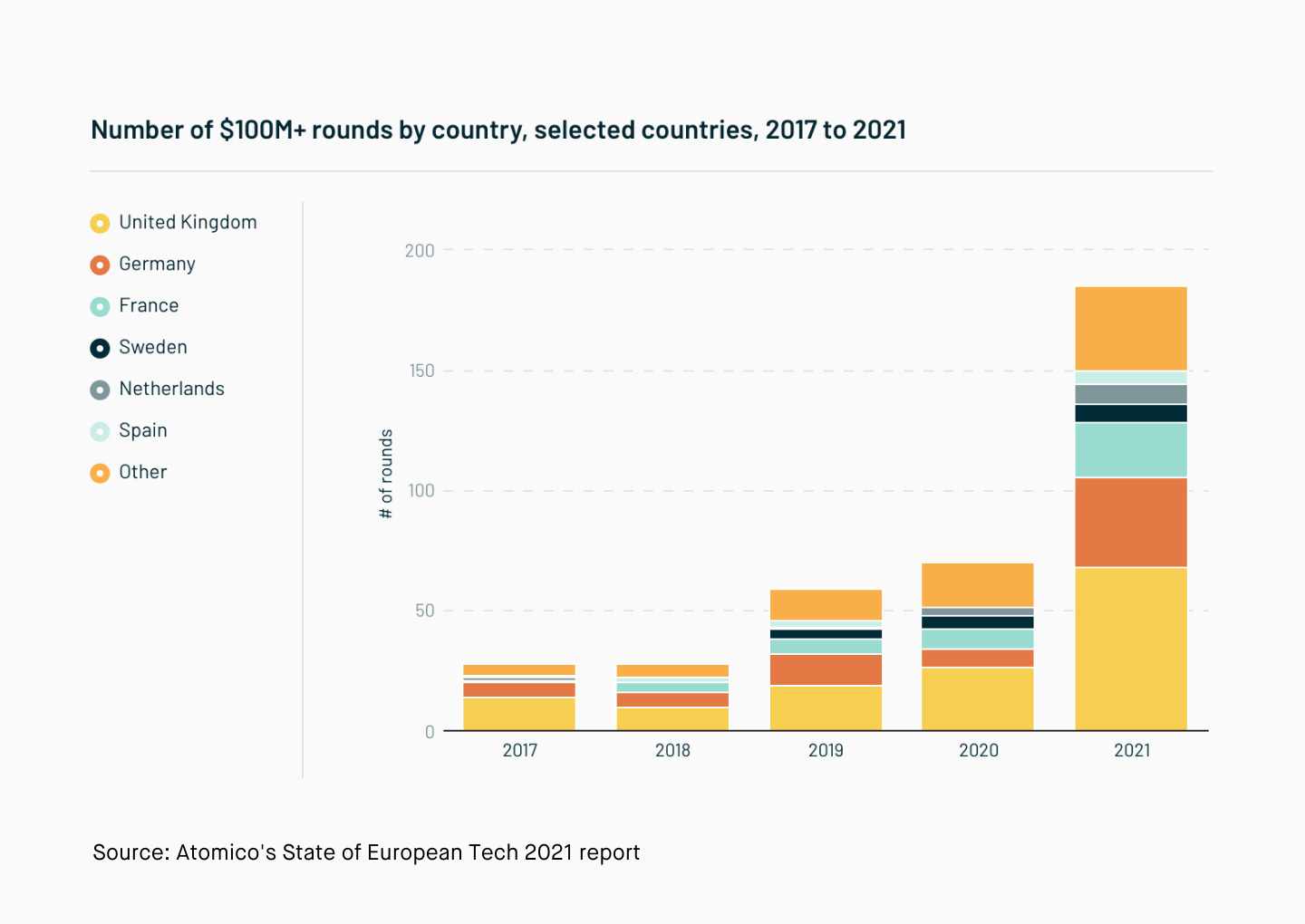

Mega funding rounds have become a fixture right across Europe in the first nine months of 2021. The Netherlands has benefited from this trend, contributing eight of these $100m+ rounds which is a significant increase on the three in 2020.

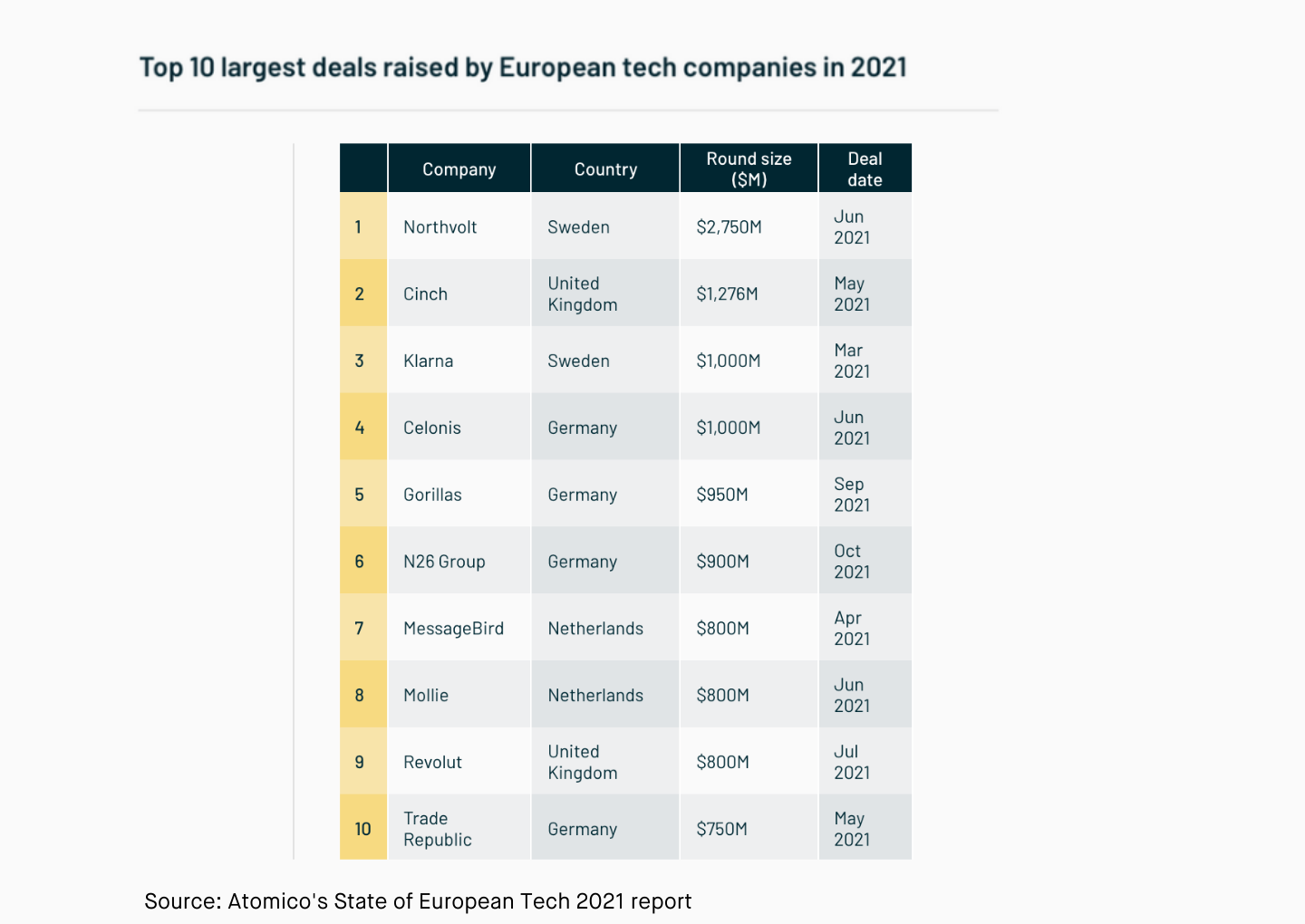

The Netherlands appears twice in the list of ten largest deals raised by European tech companies in 2021, with Mollie and MessageBird both achieving $800m in their funding rounds this year.

Despite that, we do lag behind when it comes to deeptech investments—of the top ten rounds for deeptech companies in 2021, no Dutch businesses were present. It’s clear more efforts must be made to accelerate innovation and knowledge transfer between universities and spin-offs or startups in an effort to combat this.

Early-stage deals have also continued to decrease, resulting in a funding gap for startups in the earliest, most risky phase of their business. If the Netherlands is to maintain its reputation as a flourishing startup hub, this investment gap is an area that needs to be solved.

Tech talent shortages continue to be an issue within the Netherlands, a trend that has been amplified by the pandemic and more recently, Brexit.

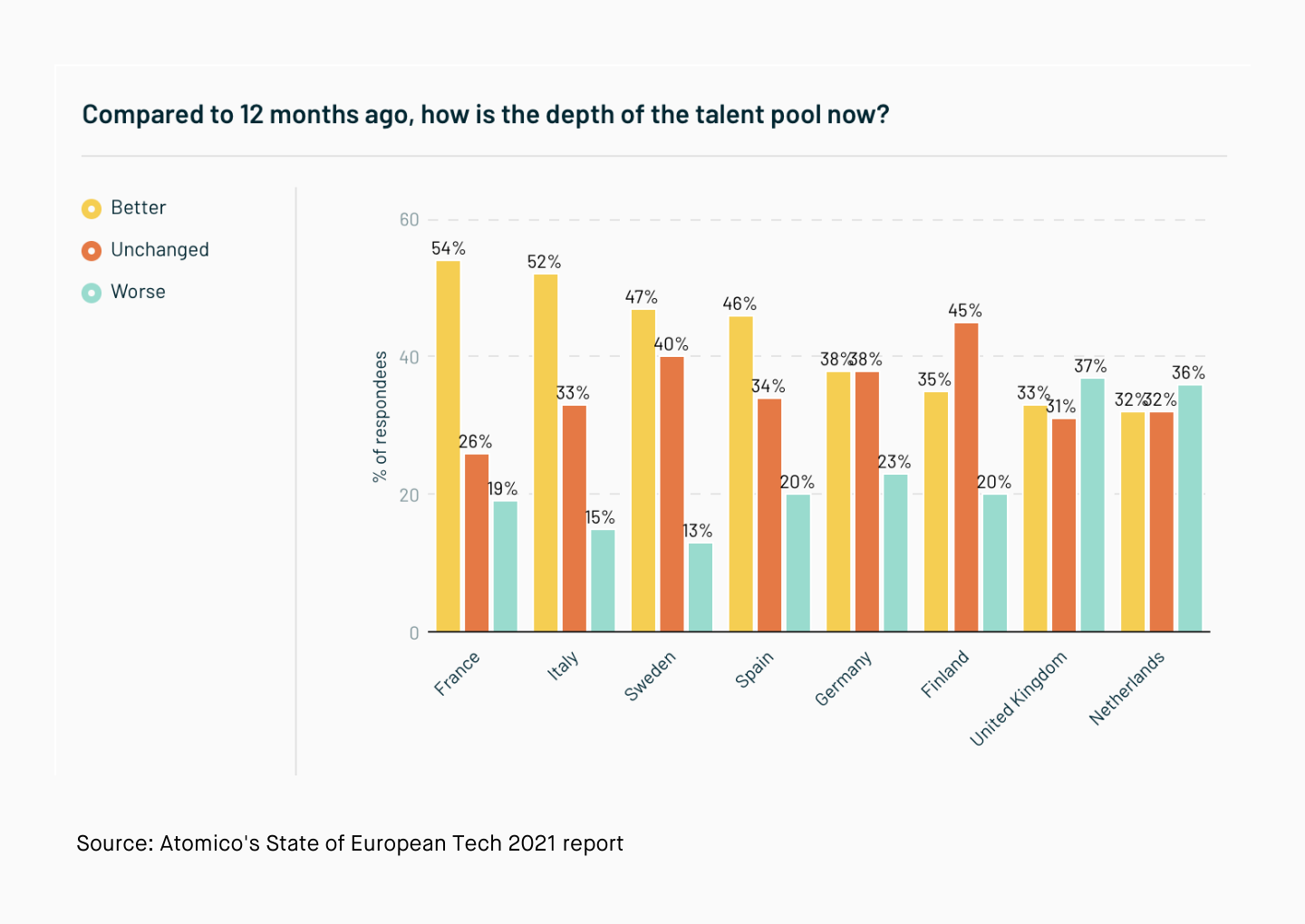

While the figures do point to competition for talent fiercely heating up right across Europe, the Netherlands has been hit particularly hard. In fact, along with the UK, the Netherlands is the only country in which founders believe the size of the talent pool on offer has decreased over the last 12 months—36% of founders thinking it has worsened compared to 32% saying it has improved.

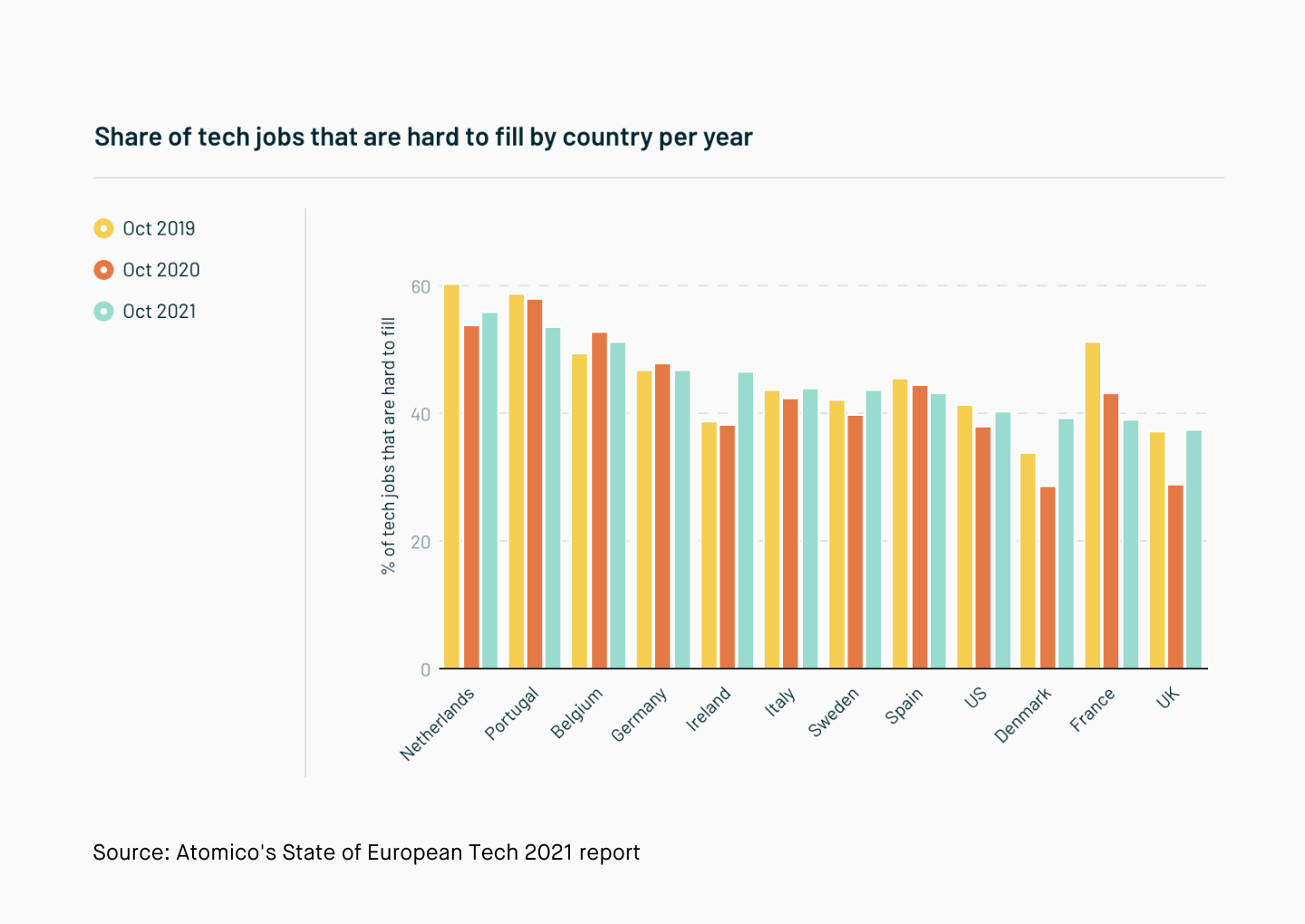

This ongoing issue is reinforced by further findings within the report, with Indeed data showing that the Netherlands holds the greatest share (56%) of tech jobs that are deemed hard to fill.

It’s clear that the nation must make changes in this regard. These talent shortages are by no means unique to the Netherlands, however, ensuring we become a more attractive base for national and international talent is essential in ensuring a healthy future for the tech ecosystem.

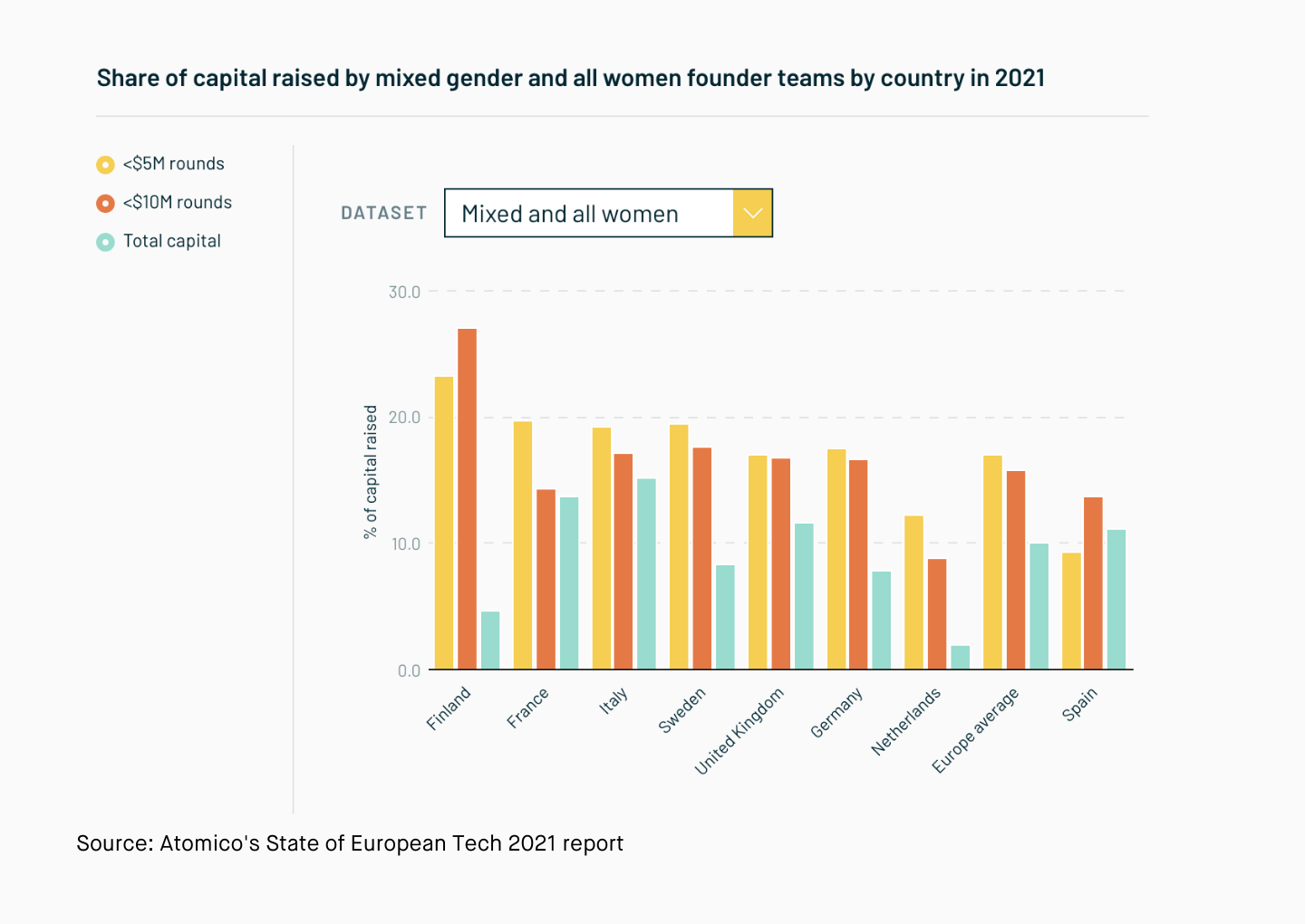

Diversity amongst founding teams is another Europe-wide problem that is particularly prevalent in the Netherlands. With 87% of founding teams receiving funding being all-men, the percentage is one of the highest on the continent, with only Czech Republic performing worse in this area.

Of the total percent of capital raised by businesses in the Netherlands, 2% of the total figure has been unlocked by mixed-gender founding teams, while only 0.1% of the overall amount has gone to all-women founding teams.

The Netherlands has cemented itself as a reliable developer of unicorns, ranking fifth in Europe when accounting for primary and secondary hubs of $1b+ companies.

We also sit fifth when it comes to potential unicorns. Based on current valuations and the last funding round coming in at least 2018, a further 36 companies have been touted to potentially achieve this status and join the 20 that already exist.

Public tech companies across the US and Europe have generally flourished over the last year, though the Netherlands’ growth does stand out from the rest after rising to fourth globally in terms of aggregate market cap, largely thanks to strong underlying performances of companies like Adyen and ASML.

This success means we continue to hold the largest share of European public tech market cap, and the value added by companies headquartered in the Netherlands in the last 12 months accounts for 47% of total European gains.

It also positions Euronext Amsterdam as Europe’s top exchange by a considerable margin. Increasing its total market cap from $435b in 2020 to $765b this year, the jump represents 38% of the overall European exchange market cap—for context, Germany’s XETRA Trading Platform is in second spot with a cap of $363.2b.

There is undoubtedly much to be excited about when it comes to the Dutch tech ecosystem, and as a nation, we continue to punch considerably above our weight in a number of areas.

However, early-stage and deep tech investment are two ongoing issues that could become notably restrictive to the wider landscape if plans aren’t made to address them. Stepping up our commitment to nurturing diversity in founding teams must also be a top priority in the coming months and years.

Following the release of the report Maurice van Tilburg, Managing Director of Techleap.nl said: “After years of building the tech ecosystem with all stakeholders, we are very happy with the overall state of Dutch tech, but we have to keep an eye on the hurdles as well.

We could claim the position of being a leading ecosystem because there are so many companies that have the chance to be very successful here. However, if we want to remain relevant as a nation and competitive as an economy, full commitment to the challenges in technological development is vital.”

Read the full State of European Tech 2021 Report: HERE

Intimate learning sessions led by scale leaders and experts

Find out the key trends and takeaways we highlighted for the Dutch tech ecosystem from the Atomico State of European Tech 2020 Report.

During a summit organised by Techleap.nl, leading investors agreed to join a taskforce to engage in international collaboration to curb climate change.

In this blog article, we summarise the key takeaways of the State of the Software Developer Nation 2021 Netherlands Report: what do software developers want from their careers and what you need to consider to attract the best talent to your company.