Find out more about employee participation

Read more about the research of I&O research into the use of employee participation among start-ups, scale-ups and innovative SMEs

Employee participation, whereby employees are participating financially in your company, allows more people to benefit from the growth of the company in the event of an exit instead of only a small group within management and investors. In the Netherlands, 4 out of 10 companies offer some form of equity to their employees, according to research by I&O research among 285 founders and employees of startups, scaleups and innovative SMEs on behalf of Techleap.nl. 34% of the startups use stock options, and 26% of the scaleups.. What are the main reasons for offering equity to employees, and what can be done to further encourage this?

Companies offer equity to employees in particular to achieve two goals: increase employee engagement with the company and allow employees to benefit from the growth of the company. Almost all founders notice that employee participation contributes to the goals of their company (I&O research 2021). It is also an important benefit for employees, according to 70% of the respondents. It allows them to identify themselves with the goals of the company and is seen as a recognition of their achievements.

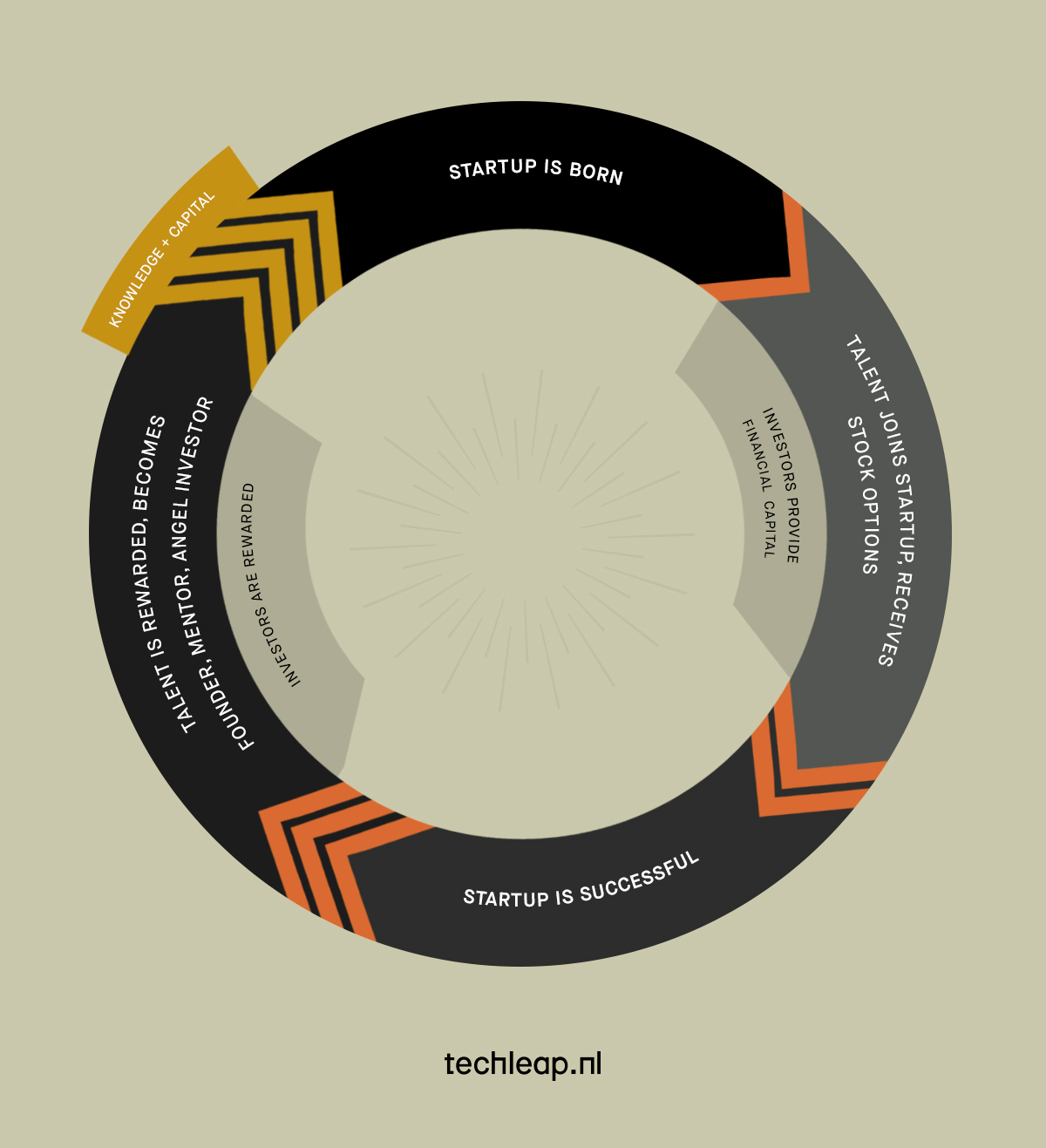

Recent research by Utrecht University, also commissioned by Techleap.nl, shows that employee participation is a powerful tool for attracting and retaining talent, but that it also ensures more innovation and better business performance. An important additional effect is that in tech ecosystems revenues often flow back into the ecosystem because employees who have been part of a successful exit often reinvest their profits in other companies or start a new company themselves. In the US, PayPal is one of the best-known examples of this, with former employees subsequently reinvesting profits in companies such as Facebook, Uber, Youtube, Tesla and SpaceX. In the Netherlands, this flywheel is still in its infancy, but it is already more explicitly visible after the successful IPO of, among others, Adyen.

In the Netherlands, stock options are taxed via payroll tax (at a high rate compared to, for example, capital gains tax as is the case in several other countries). While countries such as the US, the UK and Sweden have a facility whereby options are taxed more favourably, this is lacking in the Netherlands. Startups indicate that partly because of this we are not optimally positioning ourselves to attract the best international talent. The Dutch government is currently working on a measure to postpone the moment of taxation, but the tax rate is not part of this policy adjustment. If we really want to create a mature and successful ecosystem like the Netherlands, this is one of the measures that the new cabinet should take. In this way, we ensure that the flywheel can really start to turn in the Netherlands.

For more information, questions or suggestions, please contact Thomas Vrolijk (thomas@techleap.nl)

Read more about the research of I&O research into the use of employee participation among start-ups, scale-ups and innovative SMEs

Drie concrete voorstellen om banen te creëren en economische groei te stimuleren.

We’re thrilled to reveal the latest group of participants enrolled in Techleap.nl’s Rise Programme. Batch #4 features an incredible collection of high-impact tech scaleups, each possessing endless potential within their respective industries.

In episode #8 of The Scale Lab podcast, Marleen Vogelaar - founder of Ziel & co-founder of Shapeways - shares Ziel's scaling journey.